Little Known Questions About Insurance Billing System.

Insurance plan predictive modeling is now a kind of subjects that everyone in the field seems to take a look at, however Lots of people even now sense Not sure about what it genuinely signifies. If you listen to the phrase coverage predictive modeling, it would audio like a thing reserved for tech experts huddled close to large screens filled with code. But the truth is way more relatable. At its core, coverage predictive modeling is solely a wise strategy for making use of facts to foresee future events, serving to insurers make better decisions. And when you think about how unpredictable lifestyle is usually, who wouldn't want a little further Perception on their own side?

When we glance closer at coverage predictive modeling, it begins to really feel like getting a weather forecast for danger. Similar to you Test the climate prior to scheduling a picnic, insurers depend on predictive modeling to be aware of the probability of different outcomes. This could include estimating the probability of an automobile accident, the opportunity of another person filing a assert, as well as how long a policyholder may well keep on being a customer. All of it Appears sophisticated, but The thought is surprisingly simple. Predict designs, lower uncertainty, and make improvements to effects. As well as in an market developed on running threat, that sort of foresight is incredibly beneficial.

The 9-Minute Rule for Insurance Broker Software

The actual magic guiding insurance plan predictive modeling lies in the data. Fashionable insurers can Assemble information and facts from pretty much everywhere, which treasure trove of information aids them attract conclusions that could are actually unattainable decades in the past. Think about your driving behavior, your house natural environment, or simply your buying behaviors. All of these information can provide tiny clues that help shape predictions. When combined with impressive algorithms, the result is often a clearer photograph of hazard. It is actually like Placing with each other pieces of a puzzle that expose stuff you might not see at the outset glance.

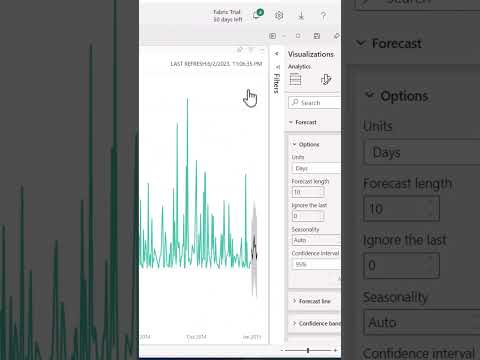

The actual magic guiding insurance plan predictive modeling lies in the data. Fashionable insurers can Assemble information and facts from pretty much everywhere, which treasure trove of information aids them attract conclusions that could are actually unattainable decades in the past. Think about your driving behavior, your house natural environment, or simply your buying behaviors. All of these information can provide tiny clues that help shape predictions. When combined with impressive algorithms, the result is often a clearer photograph of hazard. It is actually like Placing with each other pieces of a puzzle that expose stuff you might not see at the outset glance.Of course, facts By itself can be fairly useless with no suitable equipment to realize it. That may be in which State-of-the-art analytics, machine Studying, and statistical designs enter the image. With coverage predictive modeling, these applications assistance rework Uncooked data into meaningful insights. Imagine looking to browse a e-book in a very language you barely have an understanding of. Now visualize getting someone translate each term to suit your needs in serious time. That may be what predictive modeling does for facts. It turns sounds into expertise, aiding insurers make smarter decisions that gain the two their company and their buyers.

Certainly one of the most important advantages of insurance coverage predictive modeling is its ability to increase pricing precision. Visualize it using this method. As an alternative to relying on wide classes or general assumptions, insurers can tailor pricing based upon much more exact danger indicators. It's a little bit like purchasing clothing. You'll in no way need a a person sizing fits all outfit because it would under no circumstances really feel proper. With predictive modeling, pricing turns into extra custom made, helping make sure fairness and decreasing surprises for customers. And who doesn't value a value that actually reflects their own profile?

But pricing is just the beginning. Insurance plan predictive modeling also allows firms detect fraud, which is a huge challenge in the business. Anybody who has addressed surprising claims or suspicious incidents appreciates how tricky it may be to identify dishonesty. Predictive modeling acts like a digital detective, trying to find designs and anomalies that individuals could forget. By catching uncommon conduct early, insurers can conserve thousands and thousands and redirect All those resources towards bettering customer activities. It truly is a kind of powering the scenes benefits that policyholders may under no circumstances detect but unquestionably recognize.

Customer retention is yet another place exactly where insurance policies predictive modeling shines. Insurers use versions to determine which consumers could possibly cancel their procedures or change providers. The thought is analogous to noticing when a pal appears distant and might be able to drift absent. Predictive modeling picks up on delicate hints, permitting insurers to get action ahead of The shopper leaves. Whether via superior conversation, enhanced coverage solutions, or customized delivers, these insights assist Make stronger relationships. When insurers recognize their customers much better, Anyone wins.

Promises management also becomes considerably more efficient with insurance predictive modeling. Consider how stressful submitting a claim could be. Now imagine if insurers could hasten the method, anticipate troubles, and supply quicker resolutions. Predictive modeling can make that attainable. It enables insurers to categorize promises based upon complexity, estimate fees much more accurately, and allocate means far more properly. For patrons, What this means is a lot less waiting plus more assurance inside the method. For insurers, this means smoother operations and diminished expenses.

Another interesting angle is how insurance plan predictive modeling supports chance prevention. As an alternative to just reacting to challenges, insurers can establish threats in advance of they occur. It really is like possessing a dashboard warning mild that alerts you to definitely probable difficulties lengthy before your motor breaks down. One example is, insurers can analyze driving info to motivate safer practices or analyze property details to endorse hazard enhancements. The shift from reactive to proactive habits empowers customers and cuts down losses across the board.

Insurance policies predictive modeling also opens the doorway to innovation. As engineering evolves, insurers can experiment with new merchandise, dynamic pricing, and personalized tips. These innovations make the business truly feel much more fashionable and buyer pleasant. Consider finding an insurance policies present that genuinely reflects your lifestyle rather than 1 created for the generic profile. That is the way the business is heading, and predictive modeling would be the engine driving that improve.

Needless to say, no dialogue about insurance predictive modeling could be full with out acknowledging the difficulties. Knowledge privacy is a big concern, and customers be worried about how their facts is utilised. Insurers should be transparent and accountable, balancing data pushed choice generating with regard for private boundaries. It can be a delicate dance, but one which gets much easier when organizations decide to ethical methods and distinct conversation. Folks are far more ready to share details if they really feel self-confident Check Insights that it is getting taken care of responsibly.

Then There's the issue Unlock Rapidly of algorithm bias. Even quite possibly the most complex coverage predictive modeling methods can unintentionally create unfair outcomes When the underlying data is made up of hidden biases. This is a location where by human oversight will become crucial. While algorithms can method massive quantities of information, they continue to want human judgment to interpret outcomes and make sure fairness. Consider it like utilizing a GPS. It provides directions, but often you continue to have to have to look around and make your own personal choice.

Insurance Analytics Fundamentals Explained

Inspite of these problems, the main advantages of insurance predictive modeling are too considerable to ignore. It can help insurers run extra efficiently, give improved pricing, and supply far more individualized experiences. Consumers get procedures that match their needs and claims processes that come to feel smoother and Check Knowledge much more intuitive. It is difficult to argue with improvements like that. In some ways, predictive modeling helps make insurance policy feel significantly less just like a guessing video game plus more similar to a thoughtful partnership.A different critical factor is how insurance policy predictive modeling supports money stability. The insurance policy field revolves all over balancing threat and cash. By predicting long run results much more properly, businesses can allocate assets correctly and prepare for potential losses. It is just a little bit like managing your individual spending plan. If you have a greater notion of what costs might appear up, it turns into simpler to remain on the right track. Predictive modeling gives that volume of clarity over a much bigger scale.

Insurance predictive modeling also helps corporations keep competitive. With a great number of decisions available to individuals, insurers have to differentiate by themselves. The ones that use predictive modeling effectively can supply a lot quicker services, additional accurate pricing, and even more interesting solutions. These strengths develop a ripple impact, raising anticipations across the business. Prior to long, what was once cutting edge results in being the typical. And in a discipline as dynamic as insurance, being in advance on the curve can make all the real difference.

The position of technological know-how continues to expand in insurance predictive modeling. As synthetic intelligence and equipment Understanding evolve, types turn out to be far more advanced and able to dealing with large datasets. This sales opportunities to higher predictions and more refined final decision making. The evolution feels a little like going from a bicycle to your sports automobile. Both of those get you wherever you should go, but one particular does it with considerably more energy and effectiveness. Insurers that embrace these systems will be far better well prepared for your worries of tomorrow.

Insurance coverage predictive modeling also contributes to consumer empowerment. By offering insights and proposals, insurers assist shoppers make much better decisions regarding their protection and conduct. This change makes a more collaborative marriage. In place of only marketing guidelines, insurers grow to be advisors and companions. Envision possessing a guide who will help you navigate lifestyle’s uncertainties with extra assurance. That is the knowledge predictive modeling aims to generate, and it has the prospective to transform how individuals check out insurance coverage.